-

SOYBEANS

WEEKLY April 19

Rising Demand for non-GM Soybeans is Boosting Production Africa

Production of soybeans in selected African countries increased sharply to a record of an estimated 6.5 Mn T in 2022/23, compared to 2.5 Mn T ten years earlier....Soybean exports of key African countries reached a record 1.8-1.9 Mn T in Jan/Dec 2023, more than a doubling within two years.....

-

RAPESEED

WEEKLY April 19

EU Imports Set to Rise in 2024/25

EU import requirements of rapeseed & canola are set to rise in 2024/25 to offset sharply reduced supplies at the start of the season....We have lowered our EU rapeseed crop estimate to 18.3 Mn T in 2024, a downward revision of 0.5 Mn T from our estimate a month ago and down 1.7 Mn T from last year’s production.....Sharply reduced old-crop stocks will further tighten supplies...

-

BIODIESEL

WEEKLY Apr 4

World Production of Biodiesel Pegged at 62.5 Mn T in 2024

World production of biodiesel/HVO is forecast to increase by 3.7-3.8 Mn T to a record 62.5 Mn T in Jan/Dec 2024, driven upward by supportive policies mainly in key producing countries of oilseeds and vegetable oils such as the USA, Brazil and Indonesia. The biofuel sector was responsible for the bulk of the demand growth in the oils and fats market during the past four seasons, by far exceeding rather sluggish demand growth in the food sector...

-

17 OILS & FATS

MONTHLY March 28

Production Deficits Seen Developing in April/Sept 2024

Ample supplies of sunflower oil offsetting tightness in palm oil and soya oil so far this season. Pent-up demand has developed in key importing countries....

In the full season 2023/24 the increase in production of the 17 major oils and fats is expected to diminish to around 4.3 Mn T, less than half the increase registered last season. This reflects primarily the dwindling growth of palm oil production in Indonesia, of soya oil in Brazil and of sunflower oil in Russia....

-

10 OILSEEDS

MONTHLY March 28

Oilseed Crushings Accelerating Worldwide in 2024

We have raised our estimate of world crushings of 10 oilseeds to 127.3 Mn T in Jan/March 2024, 7.2 Mn T or 6.0% above the depressed level of a year earlier. Earlier expectations were exceeded in soybeans (mainly in the USA, Argentina, Brazil and China) as well as in sunflowerseed (in Russia, Ukraine and Argentina)...

Demand for seed oils turned out higher than expected, partly due to declining production and export supplies of palm oil and .... More details in the MONTHLY...

-

LINSEED

MONTHLY March 28

Proposed Import Duties Threatening EU Market

The proposal of the EU Commission to implement prohibitively high import duties of 50% on Russian oilseeds and co-products has paralysed the EU linseed market....

Russia accounted for 61% of total EU linseed imports in Jan/Dec 2023 and for even 70% in Oct/Jan 2023/24. Limited export supplies of linseed in the rest of the world (primarily Canada and Kazakhstan) would curtail EU imports and crushings in coming months, tightening supplies of linseed oil and meal correspondingly....

-

CHINA

WEEKLY Mar 22

Vegetable Oil Stocks Declining in China

Current high palm oil prices on the Dalian Commodity Exchange, which command a premium of soya oil futures, are an indication of the tight supplies in China. The reduction of stocks was quite significant in recent months. Palm oil imports plummeted by 28% on the year to 662 Thd T in the first two months of this year, which was insufficient to cover demand.....

Latest trade data for vegetable oils and oilmeals in the FLASH....

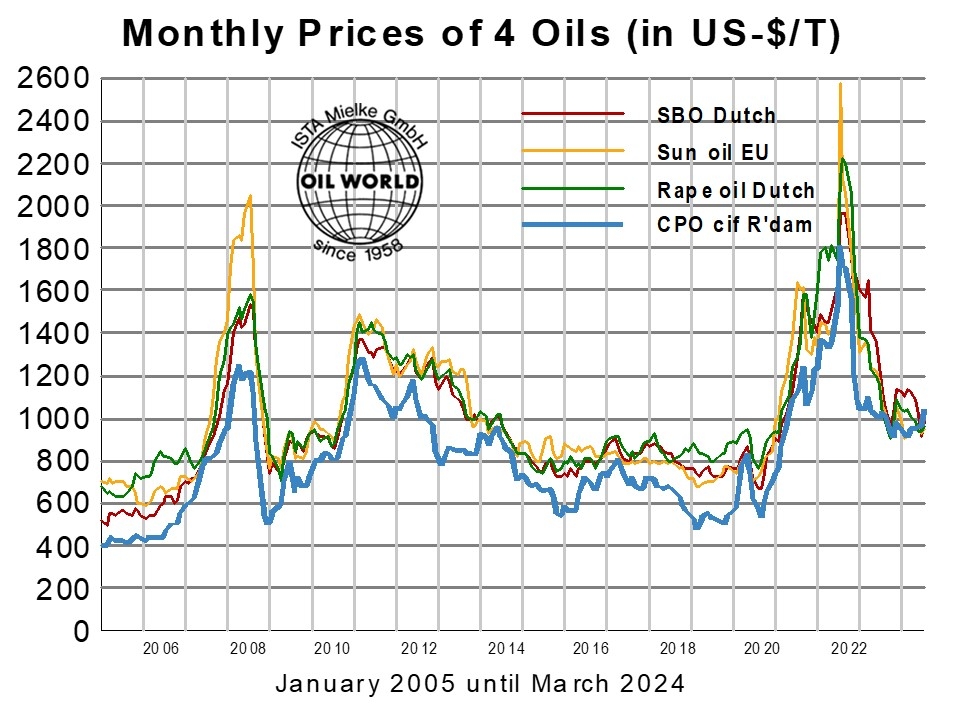

--- World Market Prices in US-$/T ---

--- World Market Prices in US-$/T ---

-

- 920 My

- April 18

- Palm olein RBD, fob Mal

-

- 462 My

- April 18

- Rapeseed, Europe, cif Hamburg

-

- 385 My

- April 18

- Soya Meal, fob Arg

-

- 1015 My

- April 18

- Rape oil, Dutch, fob ex-mill