-

CANADA

WEEKLY July 4

Canola Supply & Demand Outlook

Canadian canola crushers are likely to benefit from rallying US veg. oil prices in 2025/26 but reduced Canadian canola supplies and complex canola meal disposals will remain limiting factors. However, the improvement in Canadian canola demand prospects for the 2025/26 season apparently came too late to raise this year’s spring plantings, sparking a rally in new-crop prices on the ICE...

-

10 OILSEEDS

MONTHLY June 20

Another Increase in World Soybean Stocks Anticipated in 2025/26

Oilseed stocks are projected to continue to rise in 2025/26 for the fourth consecutive year and may reach a record 148.4 Mn T at the end of next season, if our current tentative supply & demand forecasts materialize...Our current forecasts point to relatively ample supplies of soybeans for the third consecutive season and a further increase in world stocks of soybeans to a record 127.7 Mn T at the end of the 2025/26 season, equivalent to 30.5% of annual usage.

Latest OIL WORLD supply and demand estimates for all 10 major oilseeds in the MONTHLY report....

-

U.S.A.

MONTHLY Jun 20

Supplies of Biodiesel/HVO Down Sharply in Jan/May

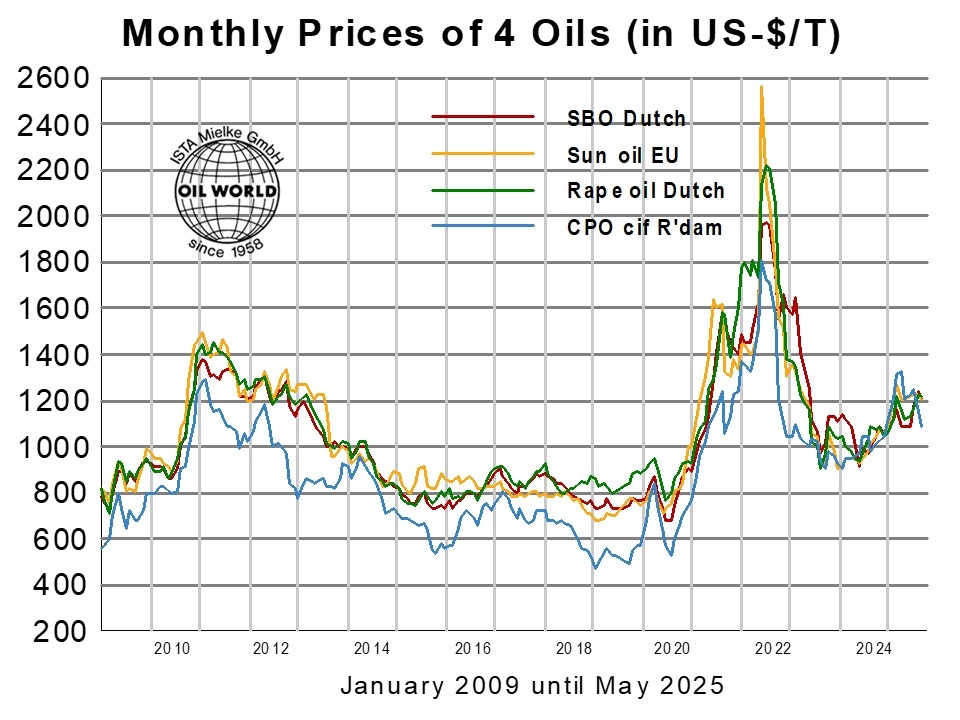

Ambitious US biofuel targets as well as escalating tensions in the Middle East have sparked a rally in global vegetable oil prices....

The volume of biomass-based diesel is projected to reach 5.61 bn gallons in the US in 2026 and 5.88 bn in 2027, implying a further sizeable increase from 3.35 bn gallons this year. However, US biodiesel/HVO supplies declined 30% in Jan/May 2025, based on the number of RINs generated....

-

17 OILS & FATS

MONTHLY June 20

Improvement in Supplies Shaping Up in 2025/26

For the 17 major oils and fats we tentatively forecast world production to increase by 5.6 Mn T or 2% in the season 2025/26, compared to an estimated 3.1 Mn T or 1% this season. Our forecast includes a slowdown of the production growth in soya oil ....

However, world stocks of oils and fats are estimated at a 4-year low of only 33.4 Mn T at the start of next season, 0.4 Mn T less than a year ago....First OIL WORLD estimates for 2025/26 in the MONTHLY...

-

OW ANNUAL

June 2025

Order Your OIL WORLD Annual 2025 NOW

Political intervention, viz. escalating trade conflicts and biofuel policies, has been the key feature in the global markets of oilseeds, oils & fats and oilmeals in recent months, making a difficult market even more complex and keeping volatility high.

The OIL WORLD price index of eight edible oils peaked this season already in November and has again been on a downtrend since early April. The bullishness initially emanating from declining production of sunflower oil, rapeseed oil and palm oil has been eased of late by declining biodiesel/HVO production, primarily in the USA, the EU-27, Argentina and China, which lowered feedstock requirements.Low mineral oil prices have hurt the competitiveness of vegetable oil-based biofuel in recent months. Furthermore, the vagaries of US biofuel policies affected feedstock demand domestically and abroad. Less biofuel has been produced for export to the USA in the EU, Singapore and China in recent months. It must be assumed that eroding exports of UCO from China to the USA have partly contributed to the pronounced decline of Chinese palm oil consumption so far this season.

For producers and consumers alike the global markets will again provide great challenges and opportunities this year. To take advantage of them you require the independent and competent information and forecasts we are providing in this unique compendium.

In the 2025 issue of the OIL WORLD ANNUAL we analyse all the important price-making factors and publish our first 2025/26 projections for each of the 10 oilseeds, 17 oils & fats and 12 oilmeals.

The ANNUAL focusses also on demand for vegetable oils and animal fats as a feedstock for biofuel production and its impact on the total global demand, trade and prices of oils and fats as well as the repercussions on oilseeds and oilmeals. This includes world production of biodiesel (with breakdown by country) as well as biodiesel imports and exports of major countries. More details in the just released OIL WORLD Annual 2025.... -

SOYA MEAL

WEEKLY Jun 6

Rising Consumption of Soya Meal in Africa

Sizable increases of soya meal consumption are shaping up in a number of African countries in 2024/25. The African continent has thus become a key outlet for growing export supplies mainly from South and North America, driven by increasing livestock production and a rising share of soya meal in mixed feed....

We estimate consumption of soya meal in 27 major African countries at 10.0 Mn T in Oct/Sept 2024/25. This implies a pronounced increase of 10%, following only marginally growth in 2023/24 ...More details in the WEEKLY...

-

SUNSEED

WEEKLY May 30

World Production of Sunflowerseed Set to Recover by 5-6 Mn T in 2025/26

World production of sunflowerseed is seen rising sharply by 5-6 Mn T in 2025/26. Our current estimate is 60.6 Mn T on the assumption of generally favourable weather conditions from now on. Farmers have expanded sunflower plantings in many countries at the expense of other crops, bringing the total area to a new high of of 31.2 Mn ha worldwide in 2025/26, 1.3 Mn ha above a year earlier and 3.1 Mn ha higher than in 2020/21......

The global supply & demand balance of sunflower oil will remain comparatively tight in 2025/26. In our tentative forecast we assume that world consumption of sunflower oil will not increase and remain close to the reduced level ....More details in the WEEKLY...

--- World Market Prices in US-$/T ---

--- World Market Prices in US-$/T ---

-

- 1007 Ag

- July 3

- Palm olein RBD, fob Mal

-

- 293 Ag

- July 3

- Soya Meal, fob Arg

-

- 1205 Ag

- July 3

- Rape oil, Dutch, fob ex-mill

-

- 437 Ag

- July 3

- Soybeans, fob Brazil